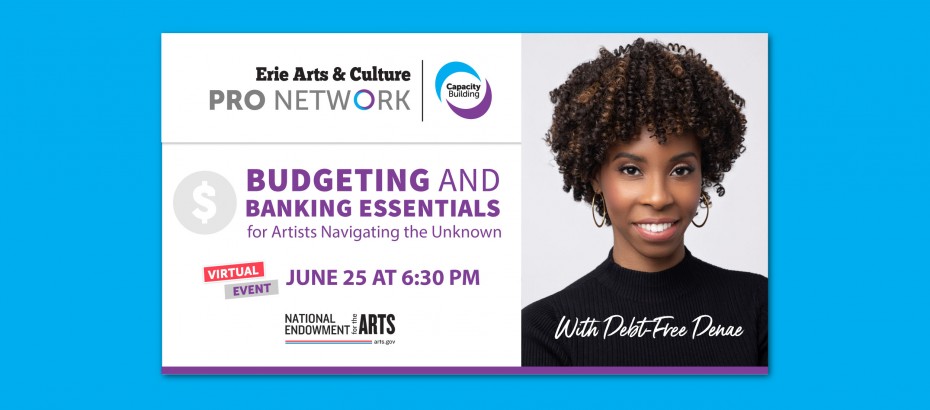

View Erie Arts & Culture's webinar above about banking and budgeting essentials with Debt-Free Denae.

Erie Arts & Culture believes that creative and cultural professionals can play a central role in developing vibrant and healthy communities and neighborhoods when they are provided with access to Professional development, Resources, and Opportunities (PRO).

We are committed to growing the capacity of our region's creative and cultural professionals. As an agency, we identified financial literacy, the knowledge necessary to make important financial decisions, as one of the key topics that we wish to advance through ongoing educational workshops and webinars. Financial literacy is important because it equips us with a greater understanding of how to manage money effectively. Education in this area builds a foundation for recognizing how our financial decisions and the actions we take—or don't take—impact our current and future success and abilities to achieve our goals.

The webinar helps artists to:

- Make better budget decisions under pressure

- Find a bank that has their best interest in mind

- Learn key best practices for budgeting and banking

When you are finished viewing, we ask that you please complete the survey below. Your feedback helps inform future PRO Network Programming.

From Debt-Free Denae:

Greetings Erie Artists!

I hope that you all have been working on your budgets and reviewing your banking institutions to make sure that they are supporting your financial goals. I wanted to do a workshop recap and provide some additional thoughts on estimating income for freelancers.

A good benchmark for freelance income goals is to aim to earn twice what you need to live.

For example, if your cost of living is $2,000 a month, then your freelance income goal would be $4,000 a month.

(Monthly Cost of Living) x 2 = Monthly Freelance Income Goal

From your Monthly Freelance Income, ideally you would allocate:

- 10% to Emergency Savings

- 20-30% to Savings for Tax Payments

- 10% to Debt Payments, Retirement or Investments

- 50% - 60% remaining to cover your Monthly Cost of Living and Large Annual Expenses

The goal is to set your income goal high enough that you are able to take care of yourself now and in the future.

As freelancers, we know that contracts can fall through at the last moment, and if there is no room in our budget or savings to make up for the loss of income, we can find ourselves in financial bind. When this happens, it’s tempting to turn to credit cards and quick loans to make up the difference. We want to avoid this!

Freelance life doesn’t always have built-in retirement plans so we have to save for retirement ourselves.

Also, having a bank that fits your needs will make sure that you have a dedicated place for your savings. I believe in every dollar working towards its purpose. Emergency savings in an emergency savings account, savings for tax payments in it’s own account - you get the idea.

By following the income allocations above, you’ll be decreasing your debt and increasing your savings each month.

Tools to Organize Your Banking and Budgeting

-

Debt-Free Denae Bank Research Matrix - Use this chart to go bank shopping and evaluate your options. Add any categories important to you so you find a great fit. Use the example matrix as a guide. Avoid monthly maintenance fees.

-

Debt-Free Denae Cost of Living Outline - Use this spreadsheet to organize and categorize your monthly expenses and estimate your cost of living. After determining your cost of living, calculate your Monthly Freelance Income Goal. Then strategize accordingly!

About Debt-Free Denae

Debt-Free Denae is a dance artist and financial wellness educator. She partners with individuals, groups, and institutions to design financial education curriculum and develop long-term financial wellness strategies. Denae believes that everyone deserves accessible financial education and counseling in a compassionate, culturally-responsive setting. She is a Certified Credit Counselor and serves on the associate board of the Council on Economic Education. She holds a B.A. in Dance from Stanford University and an M.F.A in Dance from Florida State University. Denae is currently developing a movement-based financial literacy mobile app for kids called CheerCoins.